Below is a very good video from Al Jazeera that explains the Bank of England’s emergency intervention to calm the market after the UK’s government’s tax cut plans. Once these plans were announced the GB Pound slumped to it lowest level $1.035 against the US Dollar since 1985. The BoE announced it is buying up long-dated UK government bonds to bring stability to financial markets but even higher interest rates are still likely and that is worrying news for the country’s property market. Good coverage of this below from Al Jazeera.

UK economy

UK farmers get a double hit: COVID-19 and Brexit

As COVID-19 absorbs most of the headlines worldwide there are other concerns in the UK like Brexit. The farming industry has been impacted by both:

- COVID-19 – shutdown of the service that serves the farming industry – 1/3 of the lamb market has gone.

- Brexit – a deal needs to be negotiated with the EU.

Brexit and lamb exports to the EU – when the UK was part of the EU it was part of a custom union where there was no tariff between member states but there was a Common External Tariff (CET) which meant that countries outside the EU have to pay the same tariff when they export into any EU member state. For Britain leaving the EU without a deal has serious consequences for the farming sector. Over 90% of lamb exports in the UK have gone to the EU but with no longer being a member state the industry will no have to pay a CET which will undoubtedly make UK exports more expensive in the EU market. The FT visit a farm in Wales to look at the importance of the Brexit negotiations – a lamb is valued around £80 but if the EU charges the going rate of tariff between 40-80% that would bring up the price of lamb to between £112 – £144 in EU countries. This would make it very hard for farmers to remain financially viable. Furthermore it is not just the farming sector as the UK’s overall trade with the the EU is significant:

2018 – 45% of all UK exports go to the EU – $291bn

2018 – 53% of all UK imports from the EU – $357bn

The UK produces approximately 60% of what is required to feed its population with the remainder being imported. The UK’s £110bn-a-year agriculture and food sector is deeply integrated with Europe relying on the bloc for agricultural subsidies of £3.1bn ($4bn) under the CAP – Common Agricultural Policy (explained later in the post). The government has promised to pay the equivalent of the CAP subsidies up to 2022, no one is certain what will happen after that. There lies ahead some major challenges in the UK and not just for the farming sector. The video from the FT below is very useful for explaining the impact of trade barriers and CET.

What is CAP?

At the outset of the EU, one of the main objectives was the system of intervention in agricultural markets and protection of the farming sector has been known as the common agricultural policy – CAP. The CAP was established under Article Thirty Nine of the Treaty of Rome, and its objectives – the justification for the CAP – are as follows:

1. Raise and maintain farm incomes, through the establishment of high

prices for food. Such prices are often in excess of the free market

equilibrium. This necessarily means support buying of surpluses and

raising tariffs on cheaper imported food to give domestic preference.

2. To reduce the wide flutuations that often occur in the price of agriculutural products due to uncertain supplies.

3. To increase the mobility of resources in farming and to increase the

efficiency of all units. To reduce the number of farms and farmers

especially in monoculturalistic agriculture.

4. To stimulate increased production to achieve European self

sufficiency to satisfy the consumption of food from our own resources.

5. To protect consumers from violent price changes and to guarantee a wide choice in the shop, without shortages.

CAP Intervention Price

An intervention price is the price at which the CAP would be ready to come into the market and to buy the surpluses, thus preventing the price from falling below the intervention price. This is illustrated below in Figure 1. Here the European supply of lamb drives the price down to the equilibrium 0Pfm – the free market price, where supply and demand curves intersect and quantity demanded and quantity supplied equal 0Qm. However, the intervention price (0Pint) is located above the equilibrium and it has the following effects:

1. It encourages an increase in European production. Consequently, output is raised to 0Qs1.

2. At intervention price, there is a production surplus equal to the

horizontal distance AB which is the excess of supply above demand at the

intervention price.

3. In buying the surplus, the intervention agency incurs costs equal to

the area ABCD. It will then incur the cost of storing the surplus or of

destroying it.

4. There is a contraction in domestic consumption to 0Qd1

Consumers pay a higher price to the extent that the intervention price exceeds the notional free market price.

Figure 1: The effect of an intervention price on the income of EU farmers.

The increase in farmers’ incomes following intervention is shown also: as has been noted, one of the objectives of price support policy is to raise farmers’ incomes. The shaded area EBCFG indicates the increase in the incomes of the suppliers of lamb.

Throughout most of its four decades of existence, the CAP has had a very poor public relations image. It is extremely unpopular among consumers, and on a number of occasions it has all but bankrupted the EU.

UK needs to address declining manufacturing sector

The UK economy is paying the price for the severe imbalance in its economy with the over-emphasis on the financial sector at the expense of the manufacturing. The UK hasn’t recovered from the 2008 Global Financial Crisis with real income per person only increasing 0.2% since its peak in 2007 – this is less than the per person increase in Japan during its lost decades of 1990’s and 2000’s.

What is alarming is that since the GFC the Pound has depreciated by around 30% make UK exports more competitive and imports more expensive. Within most countries a depreciation of this magnitude would give a huge boost to manufacturing sector but in the UK the impact was minimal which is indicative of the state of the sector itself. It is the poor performance of manufacturing that has seen UK’s deficit grow to 5.2% of GDP in 2015.

Although the UK is the 8th largest producer by output value but if you look at the per head output and % of national output it is much further down the pecking order – see table. Also of note is that the UK’s manufacturing output as a % of national output has dropped from 27% in 1970 to 10% in 2013. Although some have tried to play down the role manufacturing sector there has been a fundamental misunderstanding of the role of manufacturing in economic prosperity.

1. Manufacturing is the main source of productivity growth and economic prosperity – machines and chemical processes raise productivity. Also most R&D is carried out in this sector so recent increases in the service sector came about by using more advanced units in the manufacturing sector. This includes fibre-optic cables, routers, more fuel efficient cars, GPS recorders etc.

2. Many knowledge based industries have been around for a number of years – they include research, engineering etc. The vast majority of them used to be conducted by manufacturing firms and have become more visible as they have been ‘spun off’ or ‘outsourced’. Changes in a firm’s organization should not be confused with changes in the nature of economic activities.

It is important to note that the majority of this knowledge-intensive services sell to manufacturing firms, therefore their success is dependent on the state manufacturing sector.

Reversing three and a half decades of neglect will not be easy but, unless the country provides its industrial sector with more capital, stronger public support for R&D and better-trained workers, it will not be able to build the balanced and sustainable economy that it so desperately needs.

Source: The Guardian

How big can container ships get?

BBC business correspondent Alastair Fee boards a Chinese container ship off the coast of England and reports on the enormous size of it – holds 13,500 containers. And they are getter bigger. More than 40% of the UK’s sea trade comes into the Southampton Dock and to meet increasing demand from container ships a new 500 metre birth is being dredged. However trade goes the other way as in 2012 the demand for cars from the growing Chinese middle class saw over 20,000 BMW Minis make their way to Chinese ports.

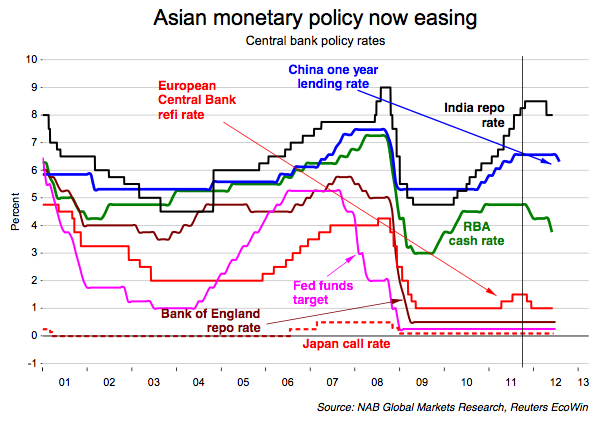

Central Bank Policy Rates – China cuts for first time since GFC

The Chinese authorities have cut interest rates for the time since the Global Financial Crisis (GFC). One year lending and deposit rates were cut by 0.25%.

Lending rate – 6.31%

Deposit rate – 3.25%

Although this should encourage spending with an increase in the money velocity in the circular flow some commentators are concerned that the Chinese authorities know something about their economy that the rest of world is in the dark about.

It is interesting to see the reaction of main central banks in the aftermath of the GFC and how aggressive they were in cutting rates – US, EU, UK – relative to the other countries on the graph, namely China, India and Australia. Furthermore notice that some economies seem to have been at a different part of the economic cycle namely Australia, India, and the EU as their central bank rates have risen in order to slow the economy down. This is especially in India as they have had strong contractionary measures in place but have now started to ease off on the cost of borrowing.

Indian growth has slowed to 5.3% this year and although this seems very healthy it is the lowest level in 7 years. A developing nation like this needs higher levels of growth to create the jobs for their vast working age population and without employment there could be a situation not unliike that of Spain where over 50% of those under 25 don’t have a job. The main cause of the slowdown seems to be from a lack of private investment.

Also look how low rates are in the US, UK, and EU. With little growth in these economies the policy instrument of lower interest rates has been ineffective and they are in a liquidity trap. Increases or decreases in the supply of money do not affect interest rates, as all wealth-holders believe interest rates have reached the floor. All increases in money supply are simply taken up in idle balances. Since interest rates do not alter, the level of expenditure in the economy is not affected. Hence, monetary policy in this situation is ineffective.

UK economy: Charles and Diana – William and Kate

After the momentous occassion of yesterday’s royal wedding it is interesting to observe the economic conditions in the UK economy today to that of the last royal wedding 30 years ago when Charles married Diana.

After the momentous occassion of yesterday’s royal wedding it is interesting to observe the economic conditions in the UK economy today to that of the last royal wedding 30 years ago when Charles married Diana.

1981 – the UK economy was in recession – have a look at the following indicators:

– unemployment was 10% = 2.65million people out of work

– Inflation 11.9%

– GDP -1.2%

Today – the economy is in much the same state:

– unemployment is 7.8% = 2.48 million people out of work

– Inflation 5.5%

– GDP 0%

So how has the approach to such dire conditions altered in 30 years? Not much according to Andrew Webb of the Financial Times.

In 1981 Chancellor of the Exchequer Geoffrey Howe proposed deep public spending cuts and tax increases in his budget. Today Chancellor George Osborne has made similar decisions and as like 1981 people have taken to the streets in protest. These decisions may reduce the budget deficit but it does run the risk of stifling demand. Furthermore with the forecast cut in the public sector unemployment is set to increase and ultimately consumer spending drop. Accross the Atlantic in 1981 Reagan was doing the opposite – cutting taxes in oder to stimulate demand.

The royal wedding might have felt like a welcome distraction from the gloom of 1981, and the year turned out to be the start of one of the longest equity bull runs we have known. The FTSE All Share began 1981 a shade under 300 and barely paused for breath until 2000 when it was worth ten times more. Apart from the obvious and short-lived feel good factor of a royal wedding, there is of course no suggestion that it has any impact on economics or the markets. Nevertheless, investors are hoping that the big day also coincides with the start of another long bull market as it did in 1981.