In 2014, 9 of the 34 members of the OECD experienced deflation whilst 3 others had zero inflation. Over the whole area consumer prices rose by only 1.7% mainly due to the fall in oil prices.

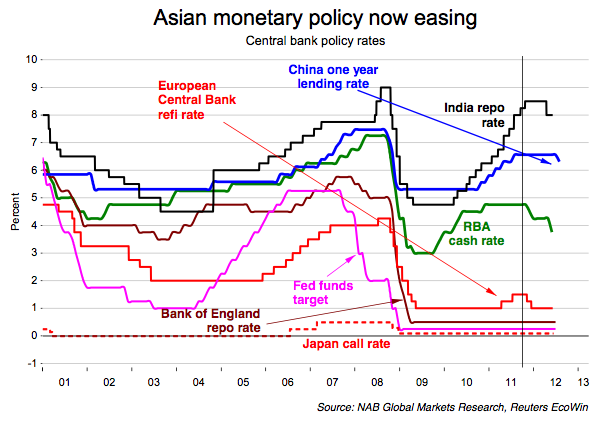

However in the Euro area inflation was only 0.4% over the year which is worrying especially as the European Central Bank (ECB) targets an annual rate of 2%. With interest rates at the ECB at 0.05% there is little scope for any stimulatory activity to increase inflation. Furthermore they are also charging banks deposits on money in the bank through a negative rate of 0.2%. Although lower oil prices will benefits businesses and consumers alike it maybe paradoxical if people expect lower inflation as cheaper energy pushes the headline rate into negative territory. So, the ECB has taken a leaf out of the US Fed’s book and decided on a form of quantitative easing by purchasing covered bonds and asset-backed securities.

Mario Draghi, President of the ECB, has not ruled out using additional measures “should it become necessary to further address risks of too prolonged a period of low inflation”.

Although Japan has an annual rate of inflation of 2.9% this has been largely due to an increase in the retail sales tax – if you exclude it from the calculation the inflation rate would be 0.9%. The Japanese Central Bank has a target of 2% inflation. As with the ECB interest rates in Japan are very low – 0.1% – so this leaves no scope for any stimulatory cuts. They are hoping that a further stimulus package of ¥3.5 trillion (NZ$ 37.41billion) on 27th December will boost the economy.

In New Zealand the annual inflation rate in September was 1% – the Reserve Bank Act 1989 stipulates a band of 1-3% while targeting future inflation at 2%. Unlike their counterparts at the ECB and the Bank of Japan they do have scope for stimulatory cuts as the official cash rate is currently 3.5%.