Something that is good to show on a Friday afternoon. Very amusing – from Charlie Brooker’s Weekly Wipe on the BBC. Every TV news report on the economy in one, courtesy of generic reporter Emily Surname. HT to Sex, Drugs and Economics and Marginal Revolution blogs.

Eco Comedy

Irish Economist Jokes for St Patrick’s Day

Being St Patrick’s Day I thought it appropriate to look at some humour.

Being St Patrick’s Day I thought it appropriate to look at some humour.

“Why was the Irish economist afraid of swimming? He was conscious of the liquidity trap.”

“How do you confuse an Irishman when trying to maximise his utility when purchasing two products? Put two shovels against the wall and tell him to take his pick.”

“What do you call it when an Irish economist has an idea? Moral Hazard”

“What is a very Irish credit rating agency? – Moody & Poor”

“An Irish economist is confused when he sees that the Irish economy has been downgraded from AAA+ to AA-. He wonders if the economy has improved by having a more powerful battery for a torch rather than a remote control”

“Did you hear about the game of Football between the public and private sector?

Unfortunately, the public sector didn’t show up because they didn’t like the idea of the public and private sector being played off against each other.”

“An Irishman said he saw a ghost. The Irish economist said it was just the invisible hand.”

“What’s the difference between Iceland’s economy and Ireland’s? One letter and six months”

“We all know what pareto optimal allocation means… What about Irish optimal allocation — when all persons are equally well off, and one person really gets it bad, worse off, while all the rest are much better off…”

“An Irish economist walks into a pizzeria to order a pizza. When the pizza is done, he goes up to the counter get it. There a clerk asks him: “Should I cut it into six pieces or eight pieces?” The Irish economist replies: “I’m feeling rather hungry right now. You’d better cut it into eight pieces.” (see the “Father Ted” version above)

“Why would Father Jack not make a good economist? There would always be massive inflation as his only policy would be to increase liquidity.”

“Why would Father Jack not make a good economist? There would always be massive inflation as his only policy would be to increase liquidity.”

Economics Correspondent – Peter O’Hanraha-Hanrahan

A lighthearted look at EU quota rates with the United States. This is part of the programme ‘The Day Today’ back in the 1990’s which was a take-off of the BBC 2 Newsnight programme hosted by Jeremy Paxton. I usually show this once I have done barriers to trade in Unit 4 of the AS course. It will be interesting to see if students find it funny.

World Cup – the economics of faking an injury.

With the end of a long first term (11 weeks) approaching I try to add a bit of humour to the classroom as generally people are tired and add to that the numerous disruptions to COVID. Later this year the football World Cup takes place in Qatar and I hark back to the last World Cup where we saw the same old tricks played by players to try and influence the decision of the referee.

- France’s Lucas Hernandez admitted to flopping in France’s 2-1 win against Australia in an attempt to get Australian midfielder Mathew Leckie sent off.

- Spanish defender Gerard Piqué accused Portugal’s captain Cristiano Ronaldo of exaggerating a fall to secure a penalty kick in their 3-3 nail-biter. Piqué said Ronaldo has a habit of “throwing himself to the ground.”

- Neymar rolling around in what seemed to be excruciating pain when there was contact on his ankle and that was on the sideline. What would he have done if it was in the penalty area and Brazil were 0-1 down?

That being said it was hoped that the VAR system would start to see this sort of tactic removed from the ‘beautiful game’. Some of the techniques of faking an injury are below – HT to Kanchan Bandyopadhyay.

The Economist has looked at this area and I thought that I would delve a little deeper. There is no doubt that if you study the costs and benefits of faking an injury there are certain sports where it is perceived as quite worthwhile – i.e. the benefits outweigh the costs. Cost benefit analysis is part of Unit 3 of the AS Level course. What is cost-benefit analysis (CBA)?

Cost Benefit Analysis (CBA) refers to estimating the private and external benefits of an investment project – airport, rail link, road etc against the private and external costs. Once these costs/benefits are established a decision is made as to whether the project should go ahead.

CBA can be applied to any decision you make and below is a table outlining the cost and benefit of faking a peanalty or injury in particular sports. I see the benefit in soccer of diving in the box and being awarded a penalty outweigh the costs by a significant amount. Firstly, if the appeal for a penalty is turned down it is very unlikely that the referee will administer any punishment to the player faking a foul. In too many cases they are happy to let the game play on as they feel under so much pressure anyway for not awarding it. Whilst in ice-hockey a suspension of either 2 or 4 minutes has acted as a deterrent to those caught “embellishing”. I have put some values in the end column which will no doubt encourage a lot of discussion – remember Warren Gatland, the Welsh coach in the Rugby World Cup 2011, considered informing a player to fake an injury so there would be no pushing in the scrums. This was after their captain, Sam Warburton, was sent off early in semi-final against France.

However, with the perceived benefits of diving in soccer it does encourage players to even practice this activity. This reminded me of a great advertisement run by the Guardian Newspaper for the Euro 2004 Soccer Cup – see below

For more on Cost-Benefit Analysis view the key notes (accompanied by fully coloured diagrams/models) on elearneconomics that will assist students to understand concepts and terms for external examinations, assignments or topic tests.

Teaching Monetary Policy – Every Breath You Take – Every Change of Rate (Fed Funds Rate)

Here is a really funny video by the students of Columbia Business School (CBS) – you may have seen it before but I find it very useful when you start teaching monetary policy and interest rates.

Back in 2006 Alan Greenspan vacated the role of chairman of the US Federal Reserve and the two main candidates for the job were Ben Bernanke and Glenn Hubbard. Glen Hubbard was (and still is) the Dean at Columbia Business School and was no doubt disappointed about losing out to Ben Bernanke. His students obviously felt a certain amount of sympathy for him and used the song “Every Breath You Take” by The Police to voice their opinion as to who should have got the job. They have altered the lyrics and the lead singer plays Glenn Hubbard.

Some significant economic words in it are: – interest rates, stagflate, inflate, bps, jobs, growth etc.

Quantitative Easing – put your printer by the window and press Enter.

Doing quantitative easing (QE) with my A2 class last period today and showed a humourous video with the late John Clarke about ‘What is Quantatitive Easing?’ – Point your printer out the window and make sure the wind is blowing in the right direction. Below is an explanation but Clarke and Dawe have an interesting take on it.

Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy when standard monetary policy has become ineffective. Governments and central banks like there to be “just enough” growth in an economy – not too much that could lead to inflation getting out of control, but not too little that there is stagnation. Their aim is the so-called “Goldilocks economy” – not too hot, but not too cold. One of the main tools they have to control growth is raising or lowering interest rates. Lower interest rates encourage people or companies to spend money, rather than save.

But when interest rates are almost at zero, central banks need to adopt different tactics – such as pumping money directly into the economy. This process is known as quantitative easing or QE.

Consumption Function Cake

Went through the consumption function this morning with my A2 class and I recalled the superb cake that A2 student Lara Hodgson made for the class a few years ago – here’s hoping for a similar cake this term. Remember that the standard Keynesian consumption function is written as follows:

C = a + c (Yd) – where:

- C = total consumer spending

- a = is autonomous spending

- c (Yd) = the propensity to spend out of disposable income

Autonomous spending (a) is consumption which does not depend on the level of income. For example people can fund some of their spending by using their savings or by borrowing money from banks and other lenders. A change in autonomous spending would in fact cause a shift in the consumption function leading to a change in consumer demand at all levels of income. The key to understanding how a rise in disposable income affects household spending is to understand the concept of the marginal propensity to consume (mpc). The marginal propensity to consume is the change in consumer spending arising from a change in disposable income. The higher the mpc the steeper the gradient of the consumption function line. As you can imagine the consumption of cake was fairly rapid.

Sign up to elearneconomics for multiple choice test questions (many with coloured diagrams and models) and the reasoned answers on Consumption Function Immediate feedback and tracked results allow students to identify areas of strength and weakness vital for student-centred learning and understanding.

Short-selling explained – ‘Trading Places’ movie

The 1983 movie ‘Trading Places’, staring Eddie Murphy and Dan Aykroyd tells the story of an upper class commodities broker Louis Winthorpe III (Aykroyd) and a homeless street hustler Billy Ray Valentine (Murphy) whose lives cross paths when they are unknowingly made part of an elaborate bet.

There is a great part in the movie when they are on the commodities trading floor that explains price and scarcity. Winthorpe and Valentine are up against the Duke Brothers in the Frozen Concentrated Orange Juice (FCOJ) futures market.

How a futures market works

As opposed to traditional stock/shares futures contracts can be sold even when the seller doesn’t hold any of the commodity. For instance a contract of $1.30 per pound for a 1000 pounds of FCOJ in February indicates that the seller is compelled to provide the produce at that time and the buyer is compelled to buy the produce.

Here’s how it worked in the movie

The Duke Brothers believe they have inside knowledge about the crop report for the orange harvest over the coming year. They are under the impression that the report will state the harvest will be down on expectations which will necessitate greater demand for stockpiling FCOJ – this will mean more demand and a higher price. Therefore at the start of trading the Dukes representative keeps buying FCOJ futures. Others saw they were only buying and wanted in on the action, those that had futures were not willing to sell so the price kept rising. However the report was fake and Winthorpe and Valentine had access to the genuine report which stated that the orange harvest had not been affected by adverse weather conditions. Knowing this they wait till the the price of FCOJ reaches $1.42 and start to sell future contracts.

Then when the crop report is announced and it indicates a good harvest investors sell their contracts and the price drops very quickly. The Dukes are unable to sell their overpriced contracts and are therefore obliged to buy millions of units of FCOJ at a price which exceeds greatly the price which they can sell them for. In the meantime Winthorpe and Valentine for every unit they sold at $1.42 they only have to pay $0.29 to buy it back to fulfill their obligation. This results in a profit of $1.13 per unit.

Brexit and “Yes Minister”

With the UK having now left the European Union here is a very amusing clip from the BBC series “Yes Minister” (1982) in which Sir Humphrey and Jim Hacker discuss Brussels and the notion of the UK trying to pretend that they are European. Also discusses why other European nations joined the common market in the first place.

Yes, Minister – Milton Friedman, Milton Keynes, Milton Schuman and Maynard Keynes

I am working may way through the Yes, Minister series and found an amusing clip where Humphery is advising Sir Desmond about the possibilities of getting the Minister to make the decision that they want him to make. However the start has Sir Desmond getting a little confused with his economists and giving his reason for buying the Financial Times.

Inflation targeting Jamaican style

From the Bank of Jamaica.

Is Artificial Intelligence like a typical economist?

Diane Coyle wrote a piece on the Project Syndicate website discussing that computers are designed to think like economists. Artificial intelligence (AI) is a faultless version of homo economicus as it is a rationally calculating, logically consistent, ends-orientated agent capable of achieving its desired outcomes with finite computational resources. They are perceived as much more effective than a human in achieving the maximum amount of utility for an individual. Coyle does go onto say that economists today cannot offer a measure of actual utility.

Jeremy Bentham’s famous formulation of utilitarianism is known as the “greatest-happiness principle”. It holds that one must always act so as to produce the greatest aggregate happiness among all sentient beings, within reason. John Stuart Mill’s method of determining the best utility is that a moral agent, when given the choice between two or more actions, ought to choose the action that contributes most to (maximises) the total happiness in the world. However this assumption can produce some unease.

- Most of those designing algorithms are utilitarians who believe that if a ‘good’ is known, then it can be maximised. Therefore how much thought is there about possible societal impacts of algorithms as they are designed to optimise efficiency and profitability.

- Algorithms are created using current and future data that is full of bias. The result could be the institutionalisation of biased and damaging decisions with the excuse of, to quote ‘Little Britain’, ‘the computer says no’. see video below.

- Algorithms make it easy for consumers to decide things and it acts as a short-cut (heuristic). Therefore we become a slave to the algorithm rather than taking more ownership of our thinking /reasoning. Those who control of the algorithm have an unfair position.

There is no doubt in certain aspects of society AI is extremely useful and can cut down bureaucracy and lead to improved efficiency in everyday life. The real issue extends beyond the use of algorithmic decision-making in corporate and political governance, and strikes at the ethical foundations of our societies. As Coyle points out we need to engage in self-reflection and decide if we really want to encode current social arrangements into the future.

Why Ireland wants a Brexit with a hard border?

Below is a funny clip by Seamus O’Rouke that was on RTE Radio 1 (Irish National Broadcaster). He has his own unique reflections on the benefits of having a hard border for the people of Leitrim.

The introduction of a hard border would have massive implications for business and personal travel between Northern Ireland. There has been an understanding between Britain and Ireland for decades that has led to this de facto agreement which has served both countries well for years. The other option is for the current situation to endure soft border, whereby vehicles, goods and people can freely pass through a porous border.

A hard border would see the reintroduction of cameras at checkpoints, and all vehicles being stopped as they approach the numerous crossing points. As it stands, there is complete freedom of movement between Northern Ireland and the Irish Republic. The border is barely recognised, with minor road markings being the only sign that you are moving between nation states.

Seamus O’Rouke tends to disagree with the soft border.

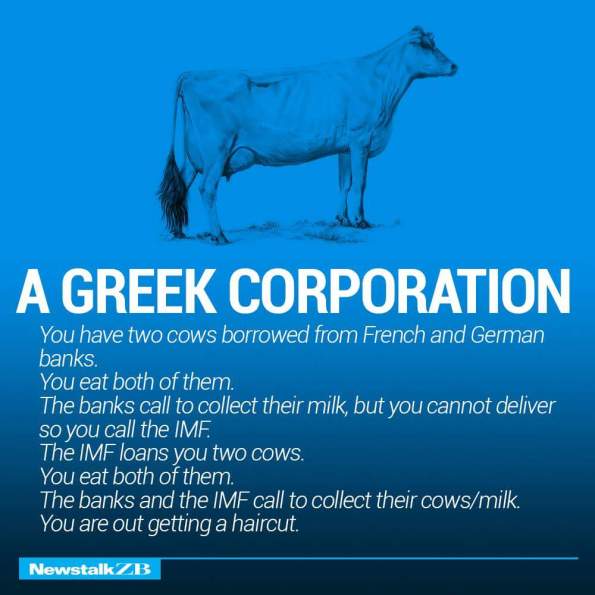

Two Cows explain economics

Two Cows explain economics

RIP John Clarke

Sad news yesterday of the passing of John Clarke. As well as his Fred Dagg character he was part of ‘Clarke and Dawe’ which aired on ABC Australia in which prominent figures speak about matters of public importance. Below is the time they look into what Quantitative Easing actually is. Very amusing and his sense of humour will be missed.

Cash is a rational birthday present but inappropriate

Here is a clip from Seinfeld that I use when teaching Behavioural Economics. It seems rational that Jerry gives Elaine $182 for her birthday but it really is inappropriate. Cash replaces social norms by market norms and ruins the feelings usually evoked by a typical non-cash birthday gift. The deadweight loss of giving is the loss of efficiency that occurs when the value of the gift to the recipient is less than the cost of the gift to the giver. In this case, economists argue that cash would be a more efficient gift.

Economic terms useful for policy

HT to Kanchan Bandyopadhyay for this piece from Bloomberg by Noah Smith entitled ‘5 Economics Terms We All Should Use’

HT to Kanchan Bandyopadhyay for this piece from Bloomberg by Noah Smith entitled ‘5 Economics Terms We All Should Use’

He suggests that rather than the usual economic terms that are banded about like recession, downturn, boom, unprecedented trade deficit etc, there are other words that are far more useful especially when you think about policy. He suggests the following:

Endogeneity

Something is endogenous when you don’t know whether it’s a cause or an effect (or both). For example, in the simple supply and demand model, suppose that there is a change in consumer tastes or preferences (an exogenous change). This leads to endogenous changes in demand and thus the equilibrium price and quantity.

Marginal versus average

Economists like to say “on the margin.” This refers to small changes instead of big overall effects. Another example is the importance of effort versus natural talent. Natural talent might matter a lot on average, but a little more effort could go a long way.

Present value and discounting

Present value means trying to figure out how much some long-term thing is worth today. Discounting means you have to decide how much less you value things that come far in the future.

Conditional versus unconditional

One common example of this is life expectancy. People like to point out that life expectancy in the Middle Ages was only about 35. But that includes lots of infant mortality. If you lived in the Middle Ages and you made it to adulthood, you would probably live well past 35. While conditional life expectancy has increased since then, it hasn’t gone up by nearly as much as the unconditional version — reductions in infant mortality have been the biggest difference.

Aggregate

Economists say that something that works individually doesn’t work in aggregate. Another good example is debt. Individually, borrowing and spending money reduces your wealth. But in aggregate, debt doesn’t reduce the value of the whole world’s wealth, since one person’s debt is another person’s asset.

I do like his comment at the end of the article:

So there are five econ terms I think should enter our everyday vocabulary. As long as this doesn’t happen endogenously, the marginal increase in the aggregate present discounted value of our public discourse would have a high conditional probability of being positive!

‘Trading Places’ movie – short-selling explained

The 1983 movie ‘Trading Places’, staring Eddie Murphy and Dan Aykroyd tells the story of an upper class commodities broker Louis Winthorpe III (Aykroyd) and a homeless street hustler Billy Ray Valentine (Murphy) whose lives cross paths when they are unknowingly made part of an elaborate bet.

There is a great part in the movie when they are on the commodities trading floor that explains price and scarcity. Winthorpe and Valentine are up against the Duke Brothers in the Frozen Concentrated Orange Juice (FCOJ) futures market.

How a futures market works

As opposed to traditional stock/shares futures contracts can be sold even when the seller doesn’t hold any of the commodity. For instance a contract of $1.30 per pound for a 1000 pounds of FCOJ in February indicates that the seller is compelled to provide the produce at that time and the buyer is compelled to buy the produce.

Here’s how it worked in the movie

The Duke Brothers believe they have inside knowledge about the crop report for the orange harvest over the coming year. They are under the impression that the report will state the harvest will be down on expectations which will necessitate greater demand for stockpiling FCOJ – this will mean more demand and a higher price. Therefore at the start of trading the Dukes representative keeps buying FCOJ futures. Others saw they were only buying and wanted in on the action, those that had futures were not willing to sell so the price kept rising. However the report was fake and Winthorpe and Valentine had access to the genuine report which stated that the orange harvest had not been affected by adverse weather conditions. Knowing this they wait till the the price of FCOJ reaches $1.42 and start to sell future contracts.

Then when the crop report is announced and it indiates a good harvest investors sell their contracts and the price drops very quickly. The Dukes are unable to sell their overpriced contracts and are therefore obliged to buy millions of units of FCOJ at a price which exceeds greatly the price which they can sell them for. In the meantime Winthorpe and Valentine for every unit they sold at $1.42 they only have to pay $0.29 to buy it back to fulfill their obligation. This results in a profit of $1.13 per unit.

Real Housewives, US Election and Economics

You may remember a previous post I did on ‘WetheEconomy’ now there is ‘WetheVoters’ The site has 20 short films designed to inform, inspire and ultimately activate voters nationwide with fresh perspectives on the subjects of democracy, elections and U.S. governance.

Below is a parody of the television programme “Real Housewives” with a political and economics twist. It shows a good example example of the current political climate and some possible avenues for change. On the one side you have Jessica who is concerned with the government balancing its budget and Lara who believes that the government needs to spend more on infrastructure etc to stimulate the economy and creates jobs. She also uses the austerity measures in the EU as an example to support her opinion. Jessica does make the point as to who is going to pay for all this spending – our kids. Then there is Vanessa who is neutral although does get into trouble by informing Lara that Jessica thinks the government should increase defence spending. From this point it gets quite heated but they do make up. Enjoy!