Alan Blinder wrote a review of Jeff Madrick’s book “Seven Bad Ideas: How Mainstream Economists Have Damaged America and the World” – in the December edition of The New York Review of Books. The basis of the book is that ‘economists’ most fundamental ideas contributed centrally to the financial crisis of 2008 and the Great recession that followed.” Blinder quoted George Stigler’s contrary verdict “that economists exert a minor and scarcely detectable influence on the societies in which they live.” He comes up with a test that asks you which of the statements below comes closer to the truth.

Alan Blinder wrote a review of Jeff Madrick’s book “Seven Bad Ideas: How Mainstream Economists Have Damaged America and the World” – in the December edition of The New York Review of Books. The basis of the book is that ‘economists’ most fundamental ideas contributed centrally to the financial crisis of 2008 and the Great recession that followed.” Blinder quoted George Stigler’s contrary verdict “that economists exert a minor and scarcely detectable influence on the societies in which they live.” He comes up with a test that asks you which of the statements below comes closer to the truth.

The dominant academic thinking, research, and writing on economic policy issues exert a profound, if not dispositive, influence on decisions made by politicians.

Politicians use research findings the way a drunk uses a lamppost: for support, not for illumination.

Most people chose the second statement but Madrick’s answer seems closer to the first.

Blinder is at odds with three of Madrick’s ‘Bad Ideas’

1. The Influence of Economists – they don’t have as much influence on economic policy as Madrick suggests.

Blinder quotes his idea of Murphy’s Law of Economic Policy:

Economists have the least influence on policy where they know the most and are most agreed; they have the most influence in policy where they know the least and disagree the most vehemently.

However when you consider who has the most influence on the election of politicians it is the general public and not economic experts. According to Binder the GFC of 2008 has in part been the fault of economists. Most graduate take at least one economics paper but professors have failed to convince the public of even the most obvious lessons, like the virtues of international trade and the success of expansionary fiscal policy in a slump. It’s a pedagogical failure on a grand scale. Many economists teach and praise the efficient market hypothesis.

2. Mainstream economics is right wing.

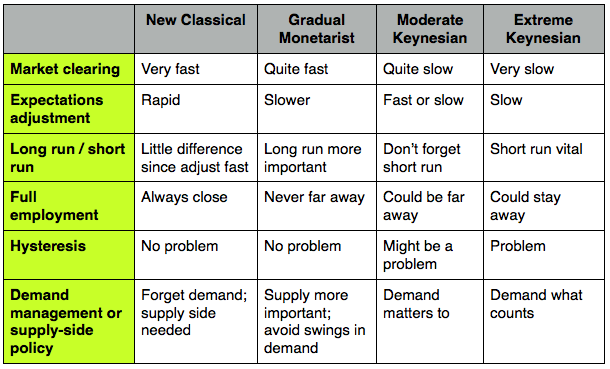

Milton Friedman (University of Chicago) is targeted by Madrick with regard to right wing doctrine. It is quoted in the book that Keynesian economics is not part of what anybody has taught graduate students since the 1960’s. Keynesian ideas are fairly tales that have been proved false. Blinder refutes these statements with the latter being farcical. One can argue over the macroeconomic policies of the Chicago School but it’s clear that their views are far from the mainstream.

The success of Keynesian policy since the GFC has been well documented. Experts were asked whether they agreed or disagreed with the two statements about fiscal stimulus.

1. Because of the American Recovery and Reinvestment Act of 2009, the US unemployment rate was lower at the end of 2010 that it have been without the stimulus bill. 82% agreed 2% disagreed

2. Taking into account all the ARRA’s economic consequences – including the economic costs of raising taxes to pay for the spending, its effects on future spending, and any other likely future effects – the benefits of the stimulus will end up exceeding its costs. 56% agreed 5% disagreed and 23% uncertain.

So from this the mainstream is overwhelmingly Keynesian.

3. Bad ideas

Madrick’s first bad idea was Adam Smith’s invisible hand. Blinder sees this as a great idea as throughout history, there has never been a serious practical alternative to free competitive markets as a mechanism for delivering the right people at the lowest possible costs. So it is essential that students learn about the virtues of the invisible hand in their first economics course.

Blinder also challenges another of Madrick’s Bad Ideas – Say’s Law, which states that supply creates its own demand, means that an economy can never have a generalized insufficiency of demand (and hence mass unemployment) because people always spend what they earn. Therefore: no recessions, no depressions. The Great Depression and then Keynes put an end to Say’s Law.

A Bad Idea – Efficient Market Hypothesis (EMH)

This Bad Idea became destructive as the EMH gave Wall Street managers the tools with which to build monstrosities like Collateralized Debt Obligations and Credit Default Swaps on top of the rickety foundation of subprime mortgages. This was further backed up by the credit rating agencies who gave AAA ratings to risky investments. EMH also handed the conservative regulators a rationale for minimal financial regulation.

According to Blinder, Madrick is an important and eloquent voice for what’s left of the American left – at least in economic matters.

Their latest debate is about industrial policy and the concept that the government can set the example of how to run successful industries – in the 1980’s textiles and today renewable energy. Although China’s growth record would seem to justify this some have seen these state run industries produce little innovation. Lin believes that countries that have a comparative advantage should receive help from the government whether it be in the form of tax cuts or improved infrastructure. Furthermore, because resources are limited the government should help in identifying industries which have earning potential. This assistance includes subsidies, tax breaks and financial incentives — aimed at supporting specific industries considered crucial for the nation’s economic growth.

Their latest debate is about industrial policy and the concept that the government can set the example of how to run successful industries – in the 1980’s textiles and today renewable energy. Although China’s growth record would seem to justify this some have seen these state run industries produce little innovation. Lin believes that countries that have a comparative advantage should receive help from the government whether it be in the form of tax cuts or improved infrastructure. Furthermore, because resources are limited the government should help in identifying industries which have earning potential. This assistance includes subsidies, tax breaks and financial incentives — aimed at supporting specific industries considered crucial for the nation’s economic growth.