Over the last 4 years the Icelandic economy has gone from financial disintegration to an emerging recovery and in doing so has taken a different policy stance than other economies faced with similar economic conditions.

How have they recovered?

How have they recovered?

1. The government guaranteed the deposits of Icelandic citizens in the banks but this did not apply to foreign investors. The banks that held foreign assets are currently being broken down and assets are being sold to pay off creditors.

2. The weak Krona has been the catalyst to recovery and exports in fish, aluminum, and tourism are up by over 10% from 2010.

3. The IMF and other Nordic countries were forthcoming with loans in order to try and stabilise the already volatile economy.

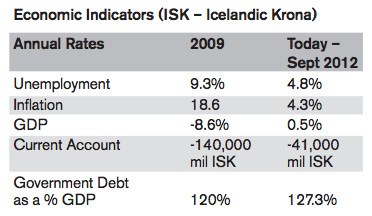

The table shows the problems that faced the Icelandic economy in 2009. With unemployment on the rise and inflation at 18.6% there was not only stagflation but the government’s debt to GDP ratio has continued to climb as officials protect the social safety net.

____________________________________________________________

The above is a brief extract from an article published in this month’s econoMAX – click below to subscribe to econoMAX the online magazine of Tutor2u. Each month there are 8 articles of around 600 words on current economic issues.